Inflation and Currency Devaluation: A Quiet Thief

If you don’t act, your money will be worthless over time. Central banks have long been targeting a 2% inflation rate, but the impact on our everyday lives is far from minimal. Everything—food, housing, education, and fuel—is growing more expensive, steadily eroding the purchasing power of your money. Holding onto cash is a losing strategy; it simply loses value each year. The only way to protect and grow your wealth is to invest in appreciating assets.

🚀 Asset Investment: The Need to Hedge

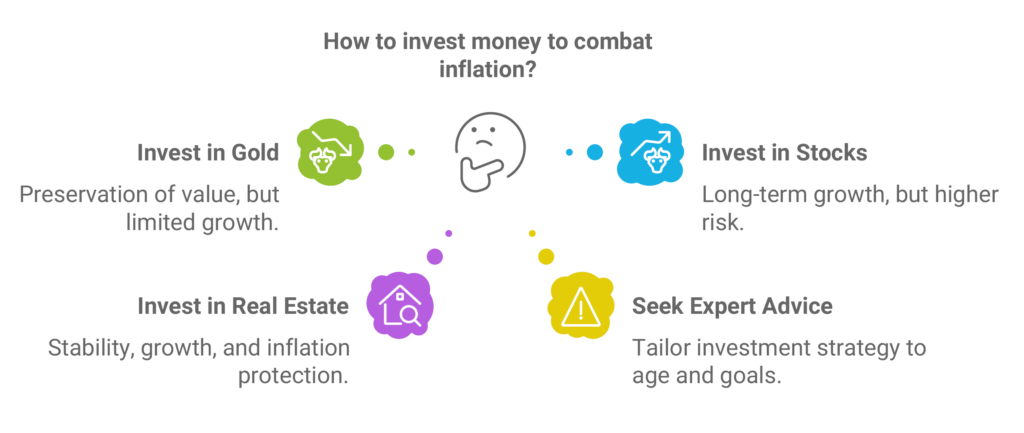

The average person has three primary ways to hedge against inflation:

The average person has three primary ways to hedge against inflation:

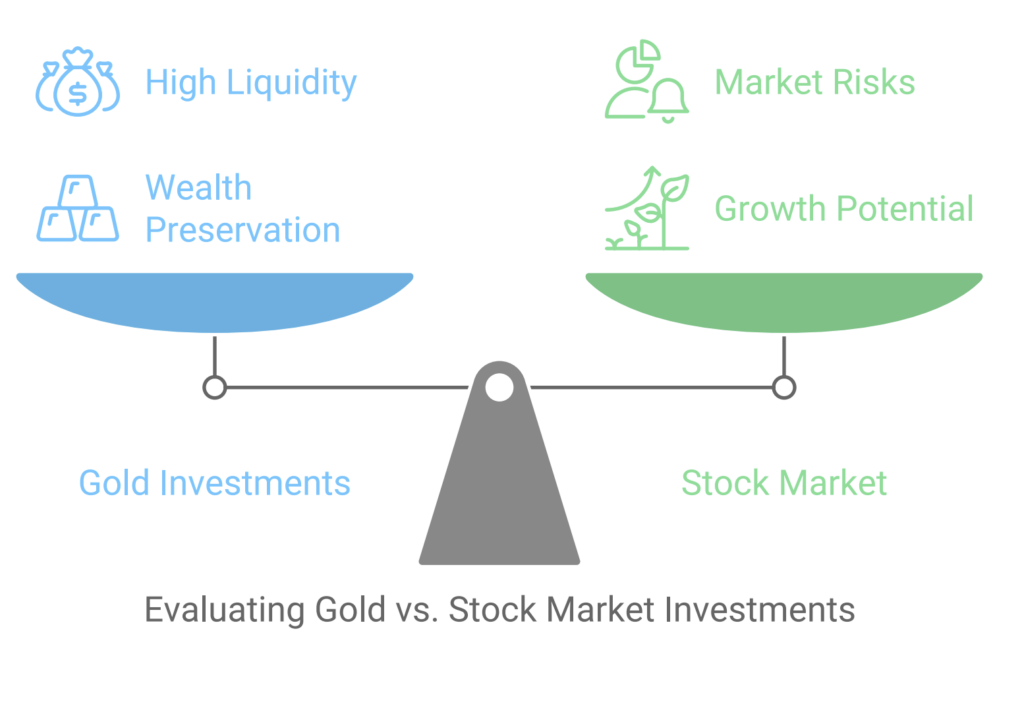

- 🏆 Gold

- Provides a hedge but doesn’t promote substantial wealth growth.

- Offers liquidity and is defensive, stopping your wealth from shrinking.

- Often used as a preservation tool, not a growth instrument.

- 📈 Stock Market

- Stocks can provide growth but come with manipulation and market risks.

- Requires a long-term view (30-40 years), focusing on stable ETFs like QQQ or SPY.

- Not advisable for those over 45, as market volatility can jeopardize short-term returns.

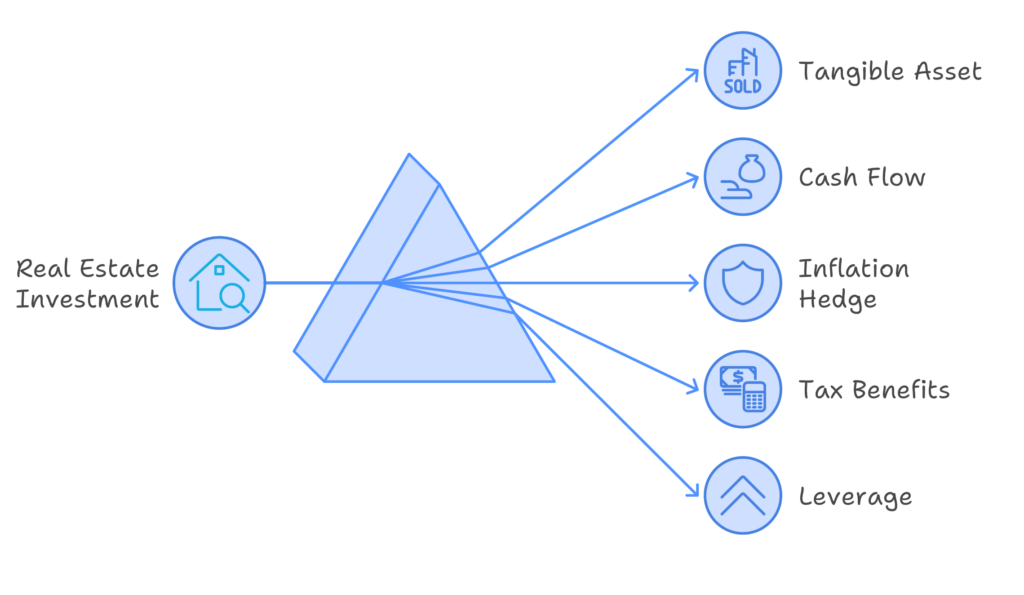

- 🏠 Real Estate

- A tangible asset that appreciates over time.

- Particularly lucrative in stable currency markets like the UAE, U.S., Canada, and parts of Europe.

- Offers both growth and a hedge against inflation, unlike paper assets.

While gold and stocks may play a role in hedging inflation, real estate stands out as an asset that provides both stability and growth potential.

🏠 Why Real Estate is the Best Investment Choice

When it comes to growing your wealth, real estate outshines other asset classes. But, not all real estate is created equal. Investing blindly is risky, much like self-diagnosing a medical condition. Consulting experts is essential—they understand market nuances and can guide you to the best opportunities.

Tangible Asset with Growing Value: Unlike stocks or bonds, real estate is a physical asset that typically appreciates over time, offering both security and long-term value.

Steady Cash Flow Opportunities: Rental properties provide consistent income streams, helping you build wealth month by month.

Hedge Against Inflation: Property values and rental income tend to rise with inflation, ensuring your investment maintains its purchasing power.

Tax Benefits & Deductions: Real estate investors can take advantage of numerous tax breaks, from mortgage interest deductions to depreciation.

Leverage & Wealth Building: Real estate allows you to use leverage, investing a small amount of your own money and borrowing the rest, which can multiply your return on investment significantly.

- If You’re Below 45: With time on your side, real estate is a strong long-term investment. Focus on properties that will appreciate over the years. The stock market is an option, but only if you’re willing to play the long-term game with low-risk assets like ETFs.

- If You’re Over 45: Real estate should be your primary focus. The volatility of the stock market makes it less suitable for those seeking quick returns or retirement security. In contrast, real estate tends to appreciate steadily, providing both safety and growth.

The younger you are, the more flexibility you have with investment options. But as you approach retirement age, tangible assets like real estate become the most reliable choice for wealth preservation and growth.

🔑 The Final Word: Move Your Wealth into Tangible Assets

The message is clear: transition your wealth into tangible, appreciating assets like real estate. Real estate not only acts as a hedge against inflation but also provides opportunities for wealth growth and financial security. With the right professional guidance, you can strategically invest in properties that will enhance your portfolio and secure your future.

Key Takeaways

- Inflation erodes the value of money, making asset investment essential.

- Gold offers preservation, stocks offer long-term growth, but both come with limitations.

- Real estate provides a unique combination of stability, growth, and protection against inflation.

- Your investment strategy should be tailored to your age and financial goals.

- Seek expert advice to make the most of real estate opportunities.

Don’t let your money lose value—invest in assets that grow. Invest in real estate.

Final Note: Invest Wisely for a Secure Future

Whether you’re starting your investment journey or safeguarding your wealth, making informed decisions is key. Real estate, with its long-term appreciation, tax benefits, and stability, offers a path that aligns with both wealth protection and growth. Make the smart move—let your money work for you.