Transform how you view market news. Learn to anticipate short-term price action and long-term trends by tracking the 10 key data releases that truly matter.

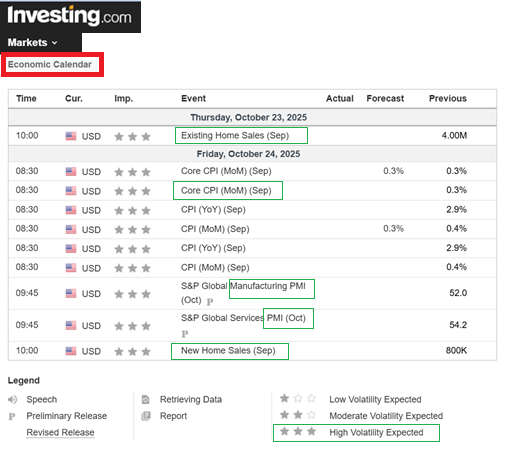

For those eager to grasp the fundamentals of market dynamics, a crucial first step is to closely monitor the economic calendar. This indispensable tool outlines scheduled data releases and events, several of which act as high-volatility catalysts. Key indicators such as the Purchasing Managers’ Index (PMI), inflation figures (like CPI), new home sales, and payroll reports not only trigger sharp short-term market movements but also significantly influence interest rate decisions, thereby shaping long-term economic trends.

You don’t need a crystal ball to predict market moves. You just need an economic calendar and the knowledge to use it.

Super Important Points in Using an Economic Calendar

- The Calendar is Your Roadmap: It provides a schedule of what data is coming out, when, and which currency it affects. This allows you to prepare for potential market activity rather than being caught off guard.

- Expectation vs. Reality is Key: The market doesn’t just react to the data itself, but to the difference between the forecast (prediction) and the actual (reported) number. A significant deviation, regardless of direction, typically causes the most volatility.

- Catalyst for Short-Term Volatility: High-impact events can cause rapid and substantial price swings in currencies, stocks, and bonds within minutes of release as traders and algorithms react to the new information.

- Driver of Long-Term Policy: This data is the primary input for central banks (like the U.S. Federal Reserve). Strong economic data may lead them to raise interest rates to combat inflation, while weak data could prompt rate cuts to stimulate growth. These decisions have long-lasting effects.

- Prioritize by Volatility Rating: Pay attention to the volatility indicators (often shown as one, two, or three bulls/stars on calendars like Investing.com). Focus your energy on “high-volatility” events, as these have the greatest potential to move the markets.

The economic calendar is your roadmap to market volatility. Ignore it, and you’re driving blind.

Top 10 Important Factors That Move Markets

These are the high-impact events you should watch for on any economic calendar. They are generally considered the most significant drivers of market sentiment and price action.

- Interest Rate Decisions (FOMC, ECB, BoE, etc.): Announcements from central banks on whether they are raising, lowering, or holding interest rates. This is arguably the most important market mover.

- Consumer Price Index (CPI): The primary measure of inflation. “Core CPI,” which excludes volatile food and energy prices, is watched especially closely to gauge underlying inflation trends.

- Non-Farm Payrolls (NFP): A key U.S. employment report that shows the number of jobs added (or lost) in the economy, excluding farm workers. It’s a strong indicator of economic health.

- Gross Domestic Product (GDP): The broadest measure of a country’s economic activity and health. It represents the total value of all goods and services produced.

- Purchasing Managers’ Index (PMI): A leading indicator of economic health for the manufacturing and service sectors. A reading above 50 indicates expansion, while below 50 signals contraction.

- Retail Sales: Measures the total receipts of retail stores, providing a direct gauge of consumer spending, which is a major driver of the economy.

- Unemployment Rate: The percentage of the labor force that is unemployed. A lower rate is typically a sign of a strong economy.

- Housing Data (e.g., Building Permits, New Home Sales, Existing Home Sales): These indicators provide insight into the health of the housing sector, which is sensitive to interest rates and a significant part of the economy.

- Consumer Confidence/Sentiment Index: Surveys that measure how optimistic or pessimistic consumers are regarding their future financial situation, which can influence their spending habits.

- Trade Balance (Imports vs. Exports): Measures the difference between a country’s exports and imports. A significant deficit or surplus can impact the value of a nation’s currency.

Markets don’t move on the news itself; they move on the gap between expectation and reality. That’s where the opportunity lies.