The world today, particularly the American experience, is a study in financial paradox. Despite unprecedented technological advancement, a massive increase in global wealth, and a surge in the physical supply of gold, the median worker faces financial pressures that would have been unthinkable to their grandparents in 1955. This disconnection between macro-economic prosperity and individual stability is the root of the widespread frustration felt by the working class globally.

1955 US Economic Data

Median Worker Annual Salary

The median annual income for men in 1955 was $3,400.

- Note: The median annual income for women was $1,100, and the median family income was $4,400.

– Data from U.S. Census Bureau Income of Persons in the United States: 1955

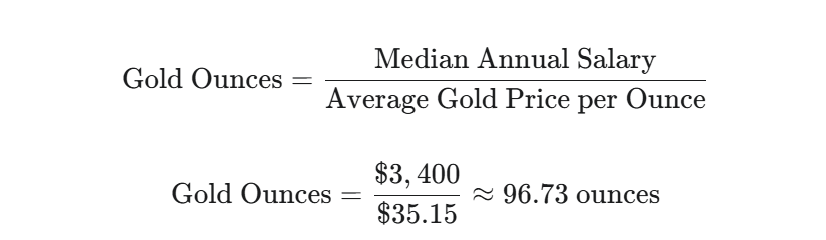

Average Gold Price and Gold Purchasing Power

The average gold price and the amount of gold a median worker could buy were:

- Average Gold Price: The average price of gold in 1955 was approximately $35.15 per ounce. This price was relatively stable due to the Bretton-Woods agreement, which fixed the dollar to gold.

- Gold Purchasing Power: A median worker (using the median income for men, $3,400) could buy approximately 96.73 ounces of gold with their annual salary in 1955.

If we calculate based on Man’s salary which was $4,400 / year, that would be = 125.17 ounces

Median Home Price

The median home price for a house in the US in 1955 was approximately $11,900.

- Note: Some sources cite an average price for a new house at around $10,950, but the median price is the more standard figure for comparison.

– DATA from U.S. Census Bureau Income of Persons in the United States: 1955

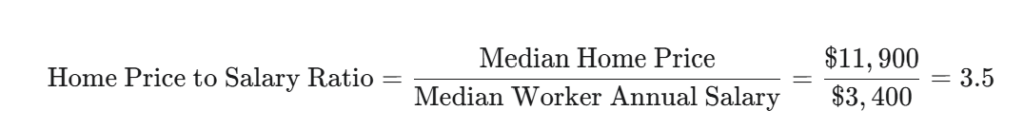

The ratio of the Median Home Price to the Median Worker Annual Salary (based on the median income for men) in 1955 was 3.5.

This means that the median home price ($11,900) was 3.5 times the median annual salary ($3,400) for a worker in the United States in 1955.

That ratio would be even lower based on Man’s based salary as not many women working actively working in 1955.

Fast Forward to 2025

2025 US Economic Data

Median Worker Annual Salary in 2025

Based on projections from the Bureau of Labor Statistics (BLS) and other sources for full-time wage and salary workers in 2025:

- Median Annual Salary (Total Workers): Approximately $62,088 (based on a median weekly wage of $1,194).

- Median Annual Salary (Men): Approximately $67,964 (based on a median weekly wage of $1,307).

For calculations, we will use the median for total workers: $62,088.

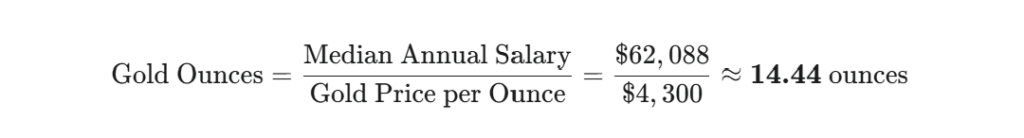

Gold Purchasing Power in 2025

Given your input that the current Gold Price in October 2025 is $4,300 per ounce:

A median worker could buy approximately 14.44 ounces of gold with their annual salary in 2025.

Median Home Price in 2025

The projected median home sale price in the US for 2025 is approximately $435,295.

- Note: Other forecasts for existing homes range from $415,200 to $422,600, but $435,295 is a recent cited median sale price.

Home Price to Salary Ratio in 2025

The ratio of the median home price to the median worker annual salary (using the $62,088 figure) is approximately 7.01.

Comparison and Calculations

You asked about two specific calculations based on the 1955 figures:

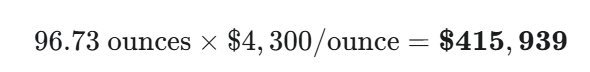

1. 1955 Gold Ounces at 2025 Price

You asked for a calculation based on the 1955 gold ounces ($96.73$) multiplied by the 2025 gold price ($4,300):

This value ($415,939) represents the purchasing power in today’s dollars if the median worker’s salary had simply kept pace with the historical appreciation of the 96.73 ounces of gold they could buy in 1955.

The Great American Theft: How the Economic System Betrayed a Generation

By Munawar Abadullah

The Generation That Got Played

We were told to work hard, save wisely, and trust the system. We were promised that productivity and innovation would deliver prosperity for all. Yet here we are in the most technologically advanced era in human history and millions of young people cannot afford a house, a family, or even the dignity of financial stability.

The uncomfortable truth is that this is not a natural outcome of “market forces.” It is a meticulously engineered crisis an economic heist orchestrated through monetary manipulation, policy corruption, and institutional greed. The so-called “2 percent inflation target” of central banks is not a noble tool for stability. It is a sanctioned form of theft, quietly draining the wealth of every working-class person, every day, in every corner of the globe.

From Gold to Paper to Nothing

In 1955, an average American man earned about $3,400 per year (man earned $4,400 but women earned $1,100). The average gold price stood at $35.15 per ounce, meaning that a single worker could buy almost 97 ounces of gold (A man could buy 125 ounces of gold) with his annual income. A decent home cost around $11,900, roughly 3.5 years of income. That was a system grounded in balance the dollar had a real tether: gold.

Then came 1971. The year the U.S. government, under President Nixon, severed the dollar from gold and replaced tangible value with political convenience. Suddenly, money could be created out of thin air no gold backing, no restraint, no accountability. The promise was that this freedom would “stabilize the global economy.” In reality, it unleashed a system where governments print, corporations profit, and citizens pay the price.

Since that fateful decision, the dollar has lost over 90 percent of its purchasing power, while real wages for the working class have stagnated. The new economic religion became perpetual inflation, justified by economists and bankers as a “necessary evil.” But evil it remains.

The Great Productivity Lie

Between the 1950s and today, worker productivity in the United States has soared by more than 300 percent, according to the Economic Policy Institute. Yet median wages have barely moved when adjusted for inflation. In other words, workers are producing three times more value but earning the same or less.

Where did the extra value go?

- It went into corporate stock buybacks, where companies spent trillions enriching shareholders instead of raising wages.

- It went into executive bonuses, rewarding those who manipulate spreadsheets rather than build anything real.

- It went into speculative financial instruments, where Wall Street turned money itself into a commodity, trading it like a drug.

And all of this was sanctioned by governments who looked the other way, seduced by campaign donations, lobbyist dinners, and promises of “growth.”

The “American Dream” once defined by ownership, opportunity, and dignity has been replaced with a treadmill of debt, anxiety, and artificial hope. The young are told to invest in crypto, flip houses, or start side hustles just to survive, while the system keeps quietly bleeding them dry.

The Engineered Inflation Scam

Let us be brutally honest: 2 percent inflation is not stability; it is robbery.

When the Federal Reserve or any central bank tells you they “target inflation,” what they really mean is they plan to erode the value of your savings every single year. Over 30 years, a 2 percent inflation rate cuts the purchasing power of a dollar by almost half.

This is not an accident. It is engineered dependence.

The state creates inflation to make debt easier to repay their debt, not yours. Governments spend recklessly, print more money, and then devalue the currency to dilute their obligations. The working class, whose savings sit in fiat, are left holding paper worth less every year. Meanwhile, the elite safeguard their wealth in hard assets real estate, equities, and commodities, which rise with inflation, ensuring they stay ahead of the curve while everyone else falls behind.

Inflation, in essence, is a hidden tax, and the working class pays it every time they buy groceries, pay rent, or fill their gas tank.

The Rise and Fall of the American Worker

Once upon a time, America was built on the backs of blue-collar workers, steelworkers, miners, builders, machinists. They were the backbone of a nation that prided itself on honest labor. Today, that backbone has been shattered.

Manufacturing jobs were shipped overseas to fuel globalization and corporate profit margins. The white-collar dream that replaced it cushy office jobs, stable careers, rising benefits is now collapsing too. Automation, outsourcing, and the gig economy have turned even the educated class into disposable labour.

Young Americans are now part of what economists politely call “the precariat” a generation of precarious workers with no security, no benefits, and no hope of upward mobility. They are the Uber drivers with master’s degrees, the nurses working double shifts, the coders drowning in debt.

The tragedy is not that they failed. The tragedy is that they believed in a system designed to fail them.

Globalization and the New Serfdom

The same system that gutted the American middle class exported its misery across the globe. Factories moved to Asia, where wages were a fraction of American levels. Western corporations preached “free markets” but practiced modern colonialism, extracting cheap labor and natural resources while dictating economic terms through the IMF and World Bank.

Now, as inflation grips the globe, workers from Manila to Manchester are discovering the same bitter truth: progress is not prosperity. The numbers look good GDP up, stock market booming, corporate profits record-high but the lived reality is one of shrinking paychecks and rising despair.

Governments proudly announce “job growth” without mentioning that most of these jobs are low-paying, temporary, and insecure.

The truth is simple. The post-gold economy has become a post-trust economy.

The Endless War Economy

For over half a century, the United States has sustained its economy not through innovation or industrial output but through perpetual warfare. Every decade brings a new conflict, a new justification, a new trillion-dollar budget allocation.

These wars often fought under the banner of “freedom” have been nothing more than economic engines, feeding defense contractors and oil conglomerates. Meanwhile, the infrastructure at home crumbles, healthcare costs explode, and education becomes a luxury.

War has become America’s most reliable export.

The Mirage of Digital Prosperity

The digital revolution was supposed to democratize opportunity. Instead, it has consolidated wealth further into the hands of a few. Big Tech now functions as a new oligarchy, controlling data, discourse, and the very architecture of human attention.

We are told to celebrate billionaires who “disrupt” industries, but what they really disrupt is the social contract itself. They profit from surveillance, exploit gig workers, and hoard the economic rewards of entire ecosystems.

The digital dollar, crypto speculation, and algorithmic finance have turned the economy into a casino, where ordinary people gamble their livelihoods in a system rigged to win for the house.

The Uncomfortable Future

The reality is this: unless something fundamentally changes, the next generation will inherit a world of endless work, meaningless money, and manufactured hope.

The American Dream, once a ladder, has become a carousel: spinning fast, going nowhere.

The system is not broken. It is functioning exactly as designed, to enrich the few, pacify the many, and disguise theft as growth.

Until we restore a form of currency or value system grounded in scarcity, productivity, and honesty, the spiral will continue. Whether that anchor is gold, Bitcoin, or a new global standard matters less than the principle behind it: money must once again mean something real.

Final Words: A Generation Awakes

The younger generation is not lazy or entitled. They are angry because they see the scam. They understand that working harder does not mean getting ahead anymore, that productivity gains flow upward, and that “inflation” is the polite term for institutional theft.

They are not frustrated because they reject work they are frustrated because their work has been devalued by design.

Until this is confronted head-on, until governments, central banks, and corporations are held accountable for decades of monetary manipulation, no stimulus package, no policy reform, no election promise will restore faith.

This generation does not need more platitudes. It needs justice economic, generational, and moral.