11 Fundamental Money Concepts Everyone Should Master

THE BASIC FINANCIAL CONCEPTS MOST PEOPLE IGNORE Wealth isn’t just about working hard or saving money. It’s about understanding the basic rules that quietly shape financial outcomes. Most people ignore these, which is why they stay stuck. Master them, and you’ll see how small shifts in behavior compound into life-changing results. Here’s the foundation: 1. […]

Investing With $10,000 as a Pakistani | Indian Expat in the Middle East

Before we begin, read this first:👉 The Foundation of Wealth: Your Safety Net Strategy If you haven’t secured your Emergency Spark Fund and Peace-of-Mind Fund, do that first.Investing without safety nets is like flying without landing gear. Step 1: Ask the Two Key Questions Step 2: Split the $10,000 into Two Tiers 1. Short to […]

THE FOUNDATION OF WEALTH: YOUR SAFETY NET STRATEGY

Before you think about stocks, real estate, or long term investment …Build your base.Without it, every investment is fragile. Here’s how: 1. The Emergency Fund This is your first shield.→ $2,000 if you’re single→ $5,000 if you have a family Keep it in USD or Gold, something stable and instantly accessible.It’s not for investing. It’s […]

THE COMPLETE GUIDE TO INVESTING FOR EXPATS

Investment questions follow me everywhere – especially from expats living outside their hometowns.The truth? It’s not a one-size-fits-all answer. Investing is personal. Like medicine, it’s not about giving “an antibiotic” and hoping it works.Each person’s life, risk tolerance, and goals are different.So the plan must be tailored, not generic. That’s why my philosophy is simple: […]

The Two Pillars of Investment Decision-Making: Capital and Commitment

Your Money and Your Mindset—The Real Starting Point Before a single dollar enters the market, an investor must reckon with two foundational truths: These are not merely financial factors. They are behavioral signals that determine your suitability for long-term investing and dictate the tools you should—or should not—use. 1. Available Capital: The Power of What […]

Think Big: Real Estate Investing Strategies of the Ultra-Wealthy

How to Invest Like a Billionaire in Real Estate 1. Look Where No One Else Is Looking 2. Control Your Risk 3. Build Strategic Partnerships 4. Think Long Term 5. Stay Educated and Adaptive 6. Leverage Debt Strategically 7. Add Value to Properties 8. Focus on Cash Flow and Capital Growth 9. Think Like a […]

The Art and Science of Professional Real Estate Analysis

In the realm of wealth creation, real estate stands as a towering pillar—a sector where calculated moves often yield immense rewards. Professional real estate analysis is both an art and a science. This newsletter delves into the essential frameworks and tools you need to navigate this intricate landscape with confidence. Market Research: Understanding the Terrain […]

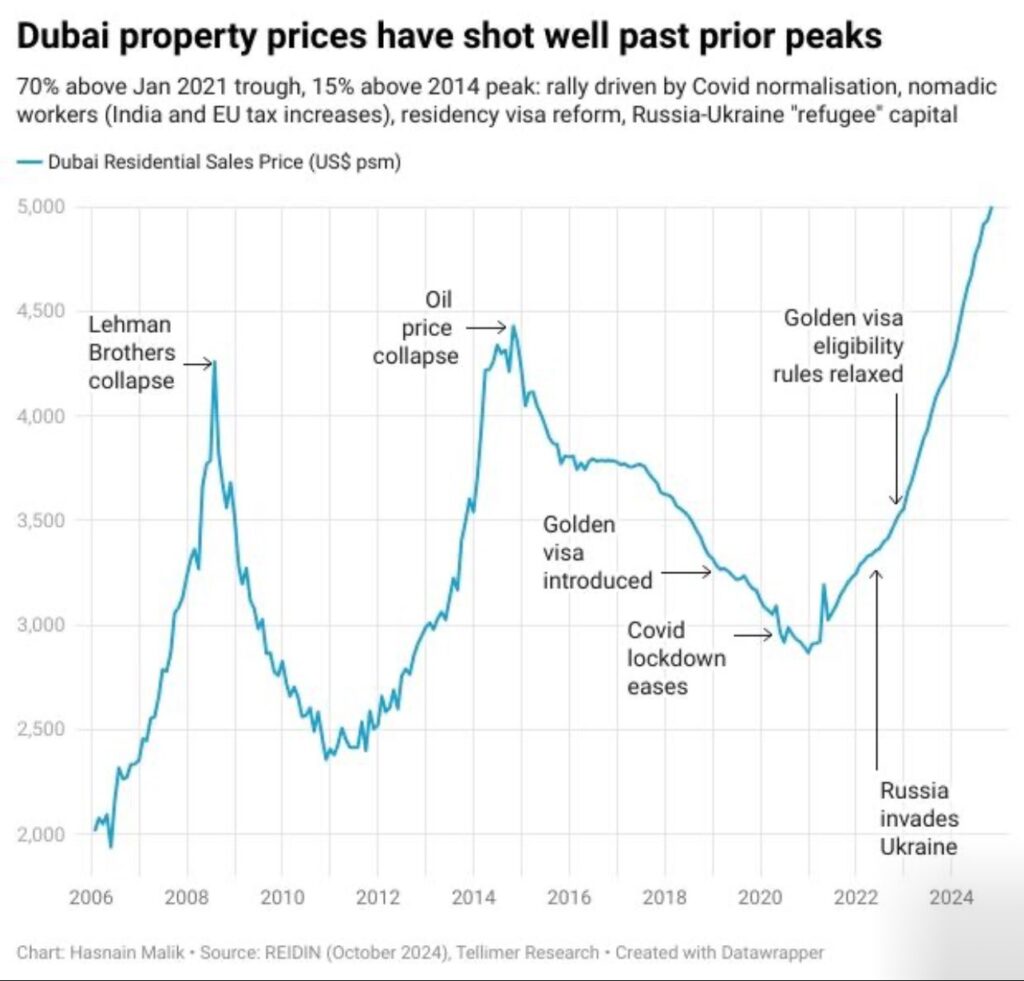

Dubai Real Estate: A Cyclical Boom-and-Bust Story with Record Highs in 2024

Dubai’s real estate market has proven remarkably resilient, bouncing back from global crises and reaching record highs in 2024. While its cyclical nature presents challenges, the emirate’s strategic reforms, tax advantages, and global positioning make it a lucrative destination for investors.

Diversifying Success: The Real Estate Wisdom for SaaS Entrepreneurs

As a SaaS entrepreneur, it’s essential to diversify beyond intangible assets. While tech businesses can thrive, investing in tangible assets like real estate provides long-term stability, capital appreciation, and a safeguard against market downturns. Learn how owning property can secure your financial future in an unpredictable world.

Your money is losing value while you read this… and here’s why.

Inflation and Currency Devaluation: A Quiet Thief If you don’t act, your money will be worthless over time. Central banks have long been targeting a 2% inflation rate, but the impact on our everyday lives is far from minimal. Everything—food, housing, education, and fuel—is growing more expensive, steadily eroding the purchasing power of your money. […]