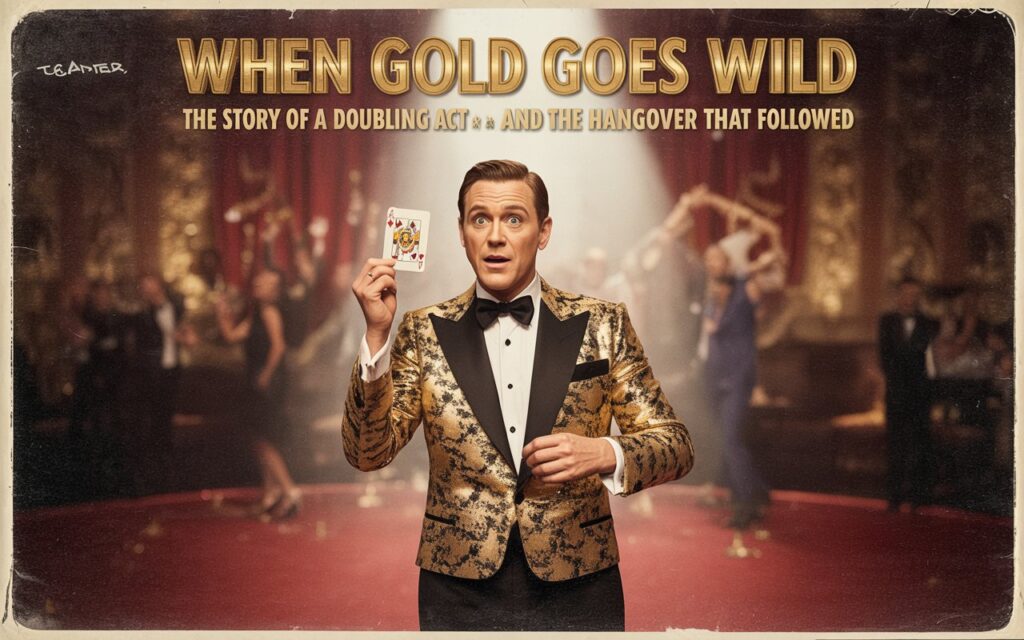

Gold. It’s more than just a shiny metal; it’s a timeless symbol of wealth, a safe haven in tumultuous times, and a fascinating barometer of global anxiety. For investors, few things are as exhilarating as watching their gold holdings soar. But what happens when this ancient asset goes on an absolute rocket ride, doubling its value in just five short years? And what’s the inevitable hangover like when the party ends?

Let’s rewind and tell the story of one such electrifying period, a time when gold captured headlines and imaginations, and then, like many high-flyers, faced its own reckoning.

The Spark: A Crisis Brews (2006 – 2011)

To understand gold’s spectacular surge, we have to travel back to the mid-2000s, a period that began with simmering economic unease and quickly escalated into a full-blown global financial crisis.

Imagine this: The year is 2006. The world economy, particularly in the West, is seemingly humming along. Yet, beneath the surface, cracks are forming. Subprime mortgages in the US are expanding rapidly, and leverage is building in the financial system. Gold, ever the vigilant sentinel, starts to stir. From average annual prices around $603 in 2006, it begins its upward march.

Then, the storm breaks. 2008 arrives, bringing with it the Great Financial Crisis. Lehman Brothers collapses, global markets plunge into chaos, and a sense of profound uncertainty grips the world. Central banks, desperate to prevent a total economic meltdown, slash interest rates to near zero and unleash unprecedented quantitative easing (QE) programs. Trillions of dollars are injected into the financial system.

And this is where gold truly begins its epic journey.

- The Narrative: Investors, shaken by the instability of traditional assets, lose faith in fiat currencies as governments print money at an alarming rate. Inflation fears begin to creep in, even as deflationary forces rage. Geopolitical tensions, though not at the forefront, add another layer of apprehension. Gold, with its inherent scarcity and lack of counterparty risk, becomes the ultimate port in the storm.

Between August 2006 and August 2011, gold embarked on a historic run. If you had invested around $730 in October 2008 (a conservative starting point during the crisis), by August 2011, your investment would have been worth approximately $1,825 an ounce. That’s a staggering 150% increase in less than three years! Looking at the broader five-year window from the average annual price of 2006 to the 2011 peak, the increase easily surpassed 100%. The yellow metal had more than doubled, transforming moderate holdings into significant wealth for many.

The Peak: An All-Time High

In August 2011, gold touched a new nominal all-time high of around $1,825 per ounce. The atmosphere was electric. Pundits debated whether gold would hit $2,000, $3,000, or even higher. Gold bugs were vindicated, and mainstream investors, who had once scoffed, started paying serious attention.

But as any seasoned market observer knows, what goes up, must, at some point, come down.

The Hangover: A Rapid Market Correction (2011 – 2015)

The subsequent years proved to be a harsh lesson in market dynamics. After its breathtaking ascent, gold entered a prolonged and painful correction that had a significant impact on investor sentiment and the broader financial markets.

Here’s what happened:

- “Taper Tantrum” and Economic Recovery Hopes: As the global economy began to stabilize and show signs of recovery, particularly in the United States, central banks started to signal a winding down of their aggressive stimulus measures. The mere mention of “tapering” QE in 2013 by the Federal Reserve sent shockwaves through the markets, leading to what became known as the “Taper Tantrum.” This shift in monetary policy indicated a return to normalcy, making safe-haven assets like gold less appealing.

- Rising Interest Rates (Prospects): The expectation of rising interest rates in the US made non-yielding assets like gold less attractive. Why hold gold, which offers no dividend or interest, when bonds might start paying a decent return again?

- Strengthening US Dollar: A stronger US dollar generally works against gold, as gold is priced in dollars. As the dollar gained strength amid US economic recovery, gold became more expensive for holders of other currencies.

- Easing Inflation Fears: While initial fears of runaway inflation from QE drove gold higher, sustained low inflation figures and a sluggish global recovery meant those fears largely failed to materialize, removing a key pillar of gold’s bull case.

- Commodity Bust: The gold correction was also part of a broader commodity bust that saw prices for oil, industrial metals, and other raw materials tumble. This was partly due to concerns about slowing growth in China and other emerging markets, which had been massive consumers of commodities.

The Impact:

- For Gold Investors: The correction was brutal. From its peak of $1,825 in August 2011, gold prices slid, eventually hitting lows around $1,050 – $1,100 by late 2015. This represented a decline of over 40% from its peak, wiping out years of gains for those who had bought at or near the top. Many individual investors, particularly those who had piled in late, experienced significant losses.

- On Overall Financial Markets: While gold’s correction didn’t trigger another financial crisis, it was a clear signal of changing tides. It reflected a shift from crisis-driven panic to a cautious optimism about economic recovery. The money that flowed out of gold often found its way back into equity markets, which began a multi-year bull run as confidence returned and corporate earnings improved. The narrative shifted from “safety first” to “growth opportunities.”

- Mining Sector: Gold mining companies, highly sensitive to gold prices, saw their profits and share prices plummet. Many were forced to cut costs, delay projects, and consolidate.

Lessons Learned

Gold’s dramatic run-up and subsequent correction offer valuable lessons:

- No Asset Goes Up Forever: Even safe havens like gold are subject to market cycles and gravitational pull.

- Context is King: Gold thrives on uncertainty, inflation fears, and a weak dollar. When these conditions reverse, gold typically struggles.

- The Narrative Can Shift: Market sentiment can change rapidly. What drives an asset up can reverse course just as quickly.

While gold has since seen renewed interest and another impressive run in the wake of new global uncertainties (hello, COVID-19 and geopolitical tensions!), the period from 2006 to 2015 remains a compelling chapter in its history. It reminds us that even the most enduring symbols of wealth are part of a dynamic, ever-evolving financial landscape, capable of both dazzling highs and sobering lows.